Greenwash or Raw Milk for Big Business? Inside Goldman Sachs.

(First in an occasional series…)

Goldman Sachs (GS), the venerated Wall Street multinational investment banking firm, first embraced environmental stewardship in 2005 when it established its “Environmental Policy Framework.” A prominently featured statement at its website is: “We remain dedicated to its core tenet:

Goldman Sachs (GS), the venerated Wall Street multinational investment banking firm, first embraced environmental stewardship in 2005 when it established its “Environmental Policy Framework.” A prominently featured statement at its website is: “We remain dedicated to its core tenet:  committing our people, capital and ideas to develop market solutions that address environmental challenges.”

committing our people, capital and ideas to develop market solutions that address environmental challenges.”

The ah-ha moment for GS may have arrived just prior to its publication of “The window for thermal coal investment is closing” by its Commodities Research division in late July 2013. First off: “Earning a return on incremental investment in thermal coal mining and infrastructure capacity is becoming increasingly difficult.” Cited in the report was the World Bank announcement earlier in the month of a new policy to “limit financing of coal-fired power plants to rare circumstances where no feasible alternatives are available.”

A key executive of a Korean-based equipment manufacturer , interviewed for the report, said: “1) even when carbon prices are low or non-existent, the downside risks of future regulation can offset the cost advantage of thermal coal relative to alternative energy sources, 2) demand for coal-fired generation remains strong in India and southeast Asia but the number of new plants is expected to decline by the end of the decade and 3) the energy sources with the most upside potential include gas and solar power.”

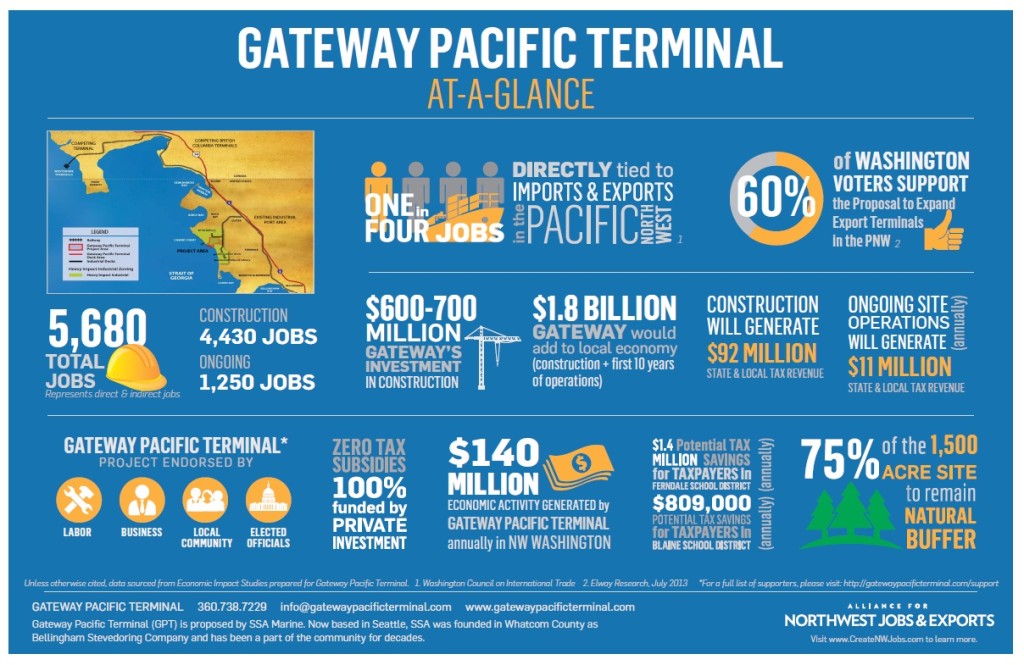

As Naomi Klein observes in her 2014 best-seller, This Changes Everything: Capitalism vs. The Climate: “Less than six months later [from publication of the research piece], Goldman Sachs sold its 49 percent stake in the company that was at the time developing the largest of the proposed coal

As Naomi Klein observes in her 2014 best-seller, This Changes Everything: Capitalism vs. The Climate: “Less than six months later [from publication of the research piece], Goldman Sachs sold its 49 percent stake in the company that was at the time developing the largest of the proposed coal  export terminals, the one near Bellingham, Washington…”

export terminals, the one near Bellingham, Washington…”

In October 2015, the White House released the latest list of companies signed on to the “American Business Act on Climate Pledge.” GS is among the 81 pledging their support for “action on climate change and the conclusion of a climate change agreement in Paris that takes a strong step forward toward a low-carbon, sustainable future.”

“By signing the American Business Act on Climate pledge, these companies are:

- Voicing support for a strong Paris outcome. The pledge recognizes those countries that have already put forward climate targets, and voices support for a strong outcome in the Paris climate negotiations.

- Demonstrating an ongoing commitment to climate action. As part of this initiative, each company is announcing significant pledges to reduce their emissions, increase low-carbon investments, deploy more clean energy, and take other actions to build more sustainable businesses and tackle climate change.These pledges include ambitious, company-specific goals such as:

- Reducing emissions by as much as 50 percent,

- Reducing water usage by as much as 80 percent,

- Achieving zero waste-to-landfill,

- Purchasing 100 percent renewable energy, and

- Pursuing zero net deforestation in supply chains.

- Setting an example for their peers. Today’s announcements build on the launch of the American Business Act on Climate Pledge in July. This fall, the Obama Administration will release a third round of pledges, with a goal of mobilizing many more companies to join the American Business Act on Climate Pledge.”

This bullet list is important for its assurance that companies are not only adopting green initiatives in their self-interest, but are willing to be identified in a public push for aggressive measures offering prospects for reigning in global warming. This public commitment solves for a worry expressed by journalist Klein about influential companies’ level of commitment to environmental healing.

GS’s 2014 Environmental, Social and Governance Reports, subtitled “Our Impact Drives Global Progress,” features a 14-page section on the environment under the headers: Overview; Journey; Business Initiatives; Risk Management; Operational Impact; and, Thought Leadership.

Among 2014 accomplishments is its leadership in Green Bonds. These are fixed-income financial instruments used in ways that include environmental benefit. A $350M green bond with an incredible 100-year maturity was used to finance DC Water’s tunnel systems which I blogged about back in July. Featured in the post was a “gigantic mechanical earthworm” aka the “Lady Bird” TBM (tunnel boring machine).

Back in 2010, GS established the Clean Technology and Renewables Group within its Investment Banking Division. Goal is to bring leadership to and focus on this sector by serving the growing capital needs of clients. The group advises, finances and invests in clean technology and renewable energy companies. This division has been called out by Bloomberg New Energy Finance as the #1 public markets lead manager for Clean Energy & Energy Smart Technologies.

(The photo of coal-laden train cars is from Standard & Partners Pty Ltd.)

This just in- PPA deal will increase D.C. government’s solar energy capacity by 70 percent. That rocks!